Visa and Mastercard announced an increase in interchange fees earlier in the year and retailers are taking action and sending a message by migrating their customers to new solutions, including mobile app-based ACH payments, and in the process increasing profits by not only reducing credit card fees but also boosting loyalty via innovative app-based incentive programs.

Liquid Barcodes CEO Mats Danielsen explains that “Visa and Mastercard are together worth over $700 billion dollars and have each seen their share prices double or over the past five years. They have lost sight that retailers have barely recovered from a painful pandemic and are simply unwilling to fund additional share price gains while watching their businesses and customers suffer.”

Money is tight, no matter who you ask. Retailers in every channel are squeezed with increasingly tighter margins on products, higher credit card fees and more pressure to keep prices competitive. Customers are trying to keep every earned dollar in their pocket with prices of goods and services at the highest level they have ever been. And last week, the U.S. Federal Reserve has raised interest rates to the highest level in 20 years in order to slow inflation which makes it even more expensive to carry a balance on a credit card.

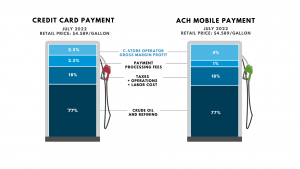

For fuel retailers, record-high gas prices make it incredibly tough to close the day’s books with a profit once expenses are factored in. Everything from higher product costs to credit card fees and everything in between lessens hopes of profitability.

According to a NACS consumer survey, “58% of gas customers say that price is the main consideration for where they fuel up.” Some customers will drive miles out of their way just to save a few pennies per gallon. This equals incredible pressure to compete for the price-conscious driver by offering the lowest possible competitive price. Yet, the lower the price, the lower the profit and that profit averages just 10-15 cents per gallon, no thanks to taxes, operating expenses and credit card fees.

Speaking of credit card fees, they are the second-highest expense for convenience retailers behind labor. While rates vary slightly, the average card processing rate is 2.5%. For example, to fill up a tank of gas using my credit card on my 18-gallon Honda Pilot here in Virginia at $4.49/gallon will cost me just over $80. That means the retailer is paying more than $2.00 in card processing fees. And, at the lower end of ten cents per gallon profit, that retailer made a whopping $1.80 on my visit – less than the card companies!

In that same consumer survey, NACS found that 86% of customers pay by credit card and despite attempts to incentivize consumers to pay with cash, customers flat-out prefer to pay with cards. And, as those prices still hover at nationwide all-time highs, it becomes harder and harder to fork over cash, even with considerable price savings on the line.

Mobile Payments Are The Solution to Reduce Credit Card Fees

Retailers have been trying for years to figure out how to squeeze more pennies out of those costly fuel transactions and found that cash payments were a little more helpful and debit transactions just ahead of that. But the pandemic shifted people away from interaction and even cash in general. Customers turned to any contactless solution available to minimize human interaction and retailers and solution providers paid attention, offering mobile apps and payment solutions.

Customers like mobile apps. They like the convenience they offer and more importantly, the savings they represent. In fact, “51% of smartphone users are more likely to use a company or brand’s mobile app when browsing or shopping on a smartphone because they can get rewards or points,” according to a 2019 survey by Google/Ipsos U.S.

Smart retailers like Maxol in Ireland have found that customers prefer to pay for fuel by their phones. Maxol recently released FuelPay which allows customers to simply drive up, chose their store and pump location on the app, and click and pay directly through the stored payment method on their phone. Several U.S. retailers such as Kum & Go, Cumberland Farms and Casey’s also have an app solution for fuel payment.

ACH Can Save Retailers Thousands of Dollars

What if fuel customers had an easy, contactless way to pay that did not involve using a credit card? Well, there is a way that is growing in popularity. ACH payments deduct directly from their bank accounts, providing a nearly real-time draw of funds, saving retailers costly credit card fees and saving customers costly interest charges.

A typical retailer sells 4,110 gallons of fuel in a day (based on an average of 1.5 million gallons annually). A card processing fee of 2.5% costs the retailer approximately eleven cents for every gallon sold if we stick with today’s price of $4.49 per gallon. If every customer that day paid by credit card, the retailer would pay about $450 in credit card fees. To process an ACH transaction costs just under 1% fee and let us say we convinced everyone that day to pay via ACH. Each gallon would generate about four cents in ACH processing fees; therefore the retailer pays $164 in fees to the banks. That is $286 less per day and more than $105,000 saved annually per store. A ten-store chain could annually save $1 million.

While it is not realistic that 100% of customers will change their behavior to pay via ACH through a mobile app, but convincing just 5% of fuel customers to pay via an app using ACH, would lead to significant savings.

Reward Customers For Using ACH as Their Preferred Payment Method

The business case to encourage customers to use ACH as a method of payment is a no-brainer for a retailer. But, convincing people to do so will take some creative marketing and strong incentives. The industry average is to offer three cents off per gallon of gas with every ACH fuel transaction. Most retailers offer a one-time sign-up bonus of 10-15 cents off per gallon. With one mobile app that combines fuel payment and a loyalty program, retailers should incent users by offering games with chances to win even higher discounts, in-store coupons and other product giveaways. Remember, credit card companies are playing the same game to win customers and offer very attractive cash-back offers to customers so it is very important that the ACH incentives are worth it to a customer.

About Liquid Barcodes

Liquid Barcodes is a leading global loyalty and digital marketing technology company specializing in the convenience and foodservice industries. The proprietary, cloud-based technology platform allows retailers to create and manage their digital marketing campaigns with a process called the “customer connection cycle’ to engage, promote and reward customers’ activities in real-time across digital and media channels.

Liquid Barcodes loyalty platform is powering loyalty programs for industry leaders across several global markets, by offering unique mobile payment programs, machine learning, personalization, subscription, gamification, loyalty, and other capabilities.

Learn more about Liquid Barcodes at LiquidBarcodes.com.

About the Author

Carolyn Schnare, Chief Content Officer, Liquid Barcodes

Carolyn Schnare has been involved with the convenience retailing industry for two decades with extensive knowledge of customer engagement and marketing, sustainability, and community outreach. Prior to Liquid Barcodes, Schnare worked at NACS (National Association of Convenience Stores) in a variety of roles from event production to membership and most recently as Director of Strategic Initiatives and host and producer of the popular industry podcast, Convenience Matters.